The record-breaking traffic during the Thanksgiving period has provided a much-needed boost to the airline stocks in the sector after a few tough months due to headwinds like high labor and fuel costs and a slowdown in domestic air travel demand. The industry is witnessing a solid recovery in demand for domestic as well as international flights. People are again booking flights, thereby leading to higher passenger revenues, which contribute to the bulk of most airlines’ top lines.

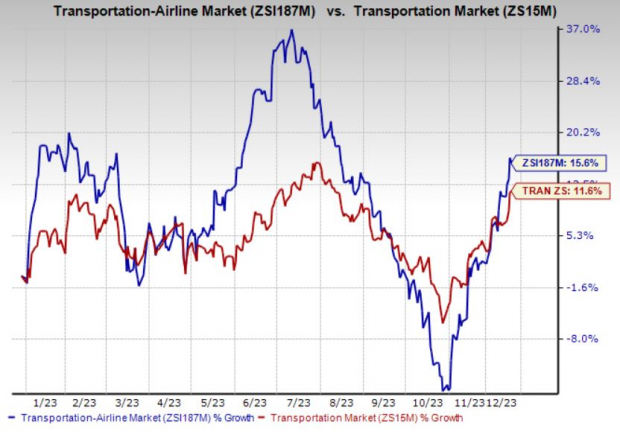

Impressive air traffic has led to a 15.6% appreciation in the Zacks Airline industry so far this year. This northward movement compares favorably with the 11.6% rise recorded by the broader Zacks Transportation sector in the same time frame.

Driven by the buoyant scenario with respect to air traffic, Copa Holdings (CPA), Azul S.A. (AZUL) and Ryanair Holdings (RYAAY) reported impressive traffic numbers for November. CPA, AZUL and RYAAY carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Driven by the buoyant scenario with respect to air traffic, Copa Holdings (CPA), Azul S.A. (AZUL) and Ryanair Holdings (RYAAY) reported impressive traffic numbers for November. CPA, AZUL and RYAAY carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Let’s take an in-depth look at these companies’ November traffic reports.

Driven by high passenger volumes, Copa Holdings’ revenue passenger miles (a measure of traffic) rose in double digits in November on a year-over-year basis. To match the demand swell, CPA is increasing its capacity. In November, available seat miles (a measure of capacity) increased 11.9% year over year. Revenue passenger miles increased 12.4%. With traffic growth outpacing capacity expansion, the load factor (percentage of seats filled by passengers) improved to 87.4% from 87.1% in November 2022.

Brazilian carrier, Azul also reported year-over-year increases in traffic and capacity for November 2023. AZUL’s consolidated revenue passenger kilometers and available seat kilometers increased 8.2% and 8.7%, respectively, on a year-over-year basis. The load factor came in at 79.2% in November 2023.

On the domestic front, revenue passenger kilometers and available seat kilometers increased 1.7% and 3.3%, year over year, respectively. The load factor came in at 78.2% in November 2023.

Internationally, revenue passenger kilometers and available seat kilometers increased 38.6% and 33.9%, respectively, on a year-over-year basis. The load factor increased to 82.5% from 79.7% in November 2022.

Ryanair, a European carrier, also reported solid traffic numbers for November, driven by upbeat air-travel demand. The number of passengers ferried on RYAAY flights in September was 11.7 million, implying that 4% more passengers flew than a year ago. The load factor was high at 92% in November 2023. The reading was similar in the year-ago period. RYAAY operated more than 66,400 flights in November 2023. However, more than 960 flights got canceled due to the Israel/Gaza conflict.

Image: Bigstock

Airlines Post Impressive November Traffic Numbers: An Analysis

The record-breaking traffic during the Thanksgiving period has provided a much-needed boost to the airline stocks in the sector after a few tough months due to headwinds like high labor and fuel costs and a slowdown in domestic air travel demand. The industry is witnessing a solid recovery in demand for domestic as well as international flights. People are again booking flights, thereby leading to higher passenger revenues, which contribute to the bulk of most airlines’ top lines.

Impressive air traffic has led to a 15.6% appreciation in the Zacks Airline industry so far this year. This northward movement compares favorably with the 11.6% rise recorded by the broader Zacks Transportation sector in the same time frame.

Let’s take an in-depth look at these companies’ November traffic reports.

Driven by high passenger volumes, Copa Holdings’ revenue passenger miles (a measure of traffic) rose in double digits in November on a year-over-year basis. To match the demand swell, CPA is increasing its capacity. In November, available seat miles (a measure of capacity) increased 11.9% year over year. Revenue passenger miles increased 12.4%. With traffic growth outpacing capacity expansion, the load factor (percentage of seats filled by passengers) improved to 87.4% from 87.1% in November 2022.

Brazilian carrier, Azul also reported year-over-year increases in traffic and capacity for November 2023. AZUL’s consolidated revenue passenger kilometers and available seat kilometers increased 8.2% and 8.7%, respectively, on a year-over-year basis. The load factor came in at 79.2% in November 2023.

On the domestic front, revenue passenger kilometers and available seat kilometers increased 1.7% and 3.3%, year over year, respectively. The load factor came in at 78.2% in November 2023.

Internationally, revenue passenger kilometers and available seat kilometers increased 38.6% and 33.9%, respectively, on a year-over-year basis. The load factor increased to 82.5% from 79.7% in November 2022.

Ryanair, a European carrier, also reported solid traffic numbers for November, driven by upbeat air-travel demand. The number of passengers ferried on RYAAY flights in September was 11.7 million, implying that 4% more passengers flew than a year ago. The load factor was high at 92% in November 2023. The reading was similar in the year-ago period. RYAAY operated more than 66,400 flights in November 2023. However, more than 960 flights got canceled due to the Israel/Gaza conflict.